Hurricanes don’t just tear through homes. They leave cars, trucks, and motorcycles battered or underwater, too. If you just bought a car or rely on yours to get to work, the thought of losing it in a storm is terrifying. The truth is, whether your insurance will step in after a hurricane depends less on having “full coverage” and more on the specific type of policy you carry.

TL;DR Does Car Insurance Cover Hurricane Damage in Florida?

Yes, but only if you have the right coverage. In Florida, comprehensive insurance is what pays for hurricane damage and natural disaster damage, whether your car is flooded by storm surge, crushed by a fallen tree, or shattered by flying debris.

In other words, comprehensive coverage is what covers damage caused by “acts of nature,” including hurricanes, tornadoes, wildfires, and lightning strikes. Liability-only policies won’t pay a dime if a storm destroys your car. That big-picture answer matters, but the details of your policy decide how much protection you really have. Let’s break down the main types of car insurance in Florida and how each responds to hurricane damage.

What Types of Auto Insurance Cover Hurricane Damage?

As we’ve mentioned, not every policy will protect your car when a storm hits. Comprehensive coverage, sometimes called “other than collision”, is the one that steps in for hurricane damage. It covers flooding, storm surge, falling trees, shattered glass, and even theft if looters target vehicles after the storm. If you financed or leased your car, this coverage is usually required. Fairly speaking, it’s the only protection that makes sense in a coastal state like Florida, where hurricanes are a real threat every year.

Other types of insurance don’t cover weather-related damages.

- For example, collision coverage only applies if you crash into something while driving, such as sliding into a pole on a flooded road. It won’t help if rising water or debris destroys your parked vehicle.

- Liability insurance, which Florida requires, protects other people and their property when you cause an accident. It does nothing for your own car if it’s totaled by a hurricane.

- Finally, GAP insurance can be a lifeline if your financed car is declared a total loss. It covers the difference between what you still owe on your loan and what the insurance company says the car is worth—something many drivers learn the hard way after hurricanes, when payouts don’t match loan balances.

Knowing what each policy does is only half the story. To really see why coverage matters, it helps to look at the kinds of damage hurricanes actually leave behind.

Common Hurricane-Related Car Damages

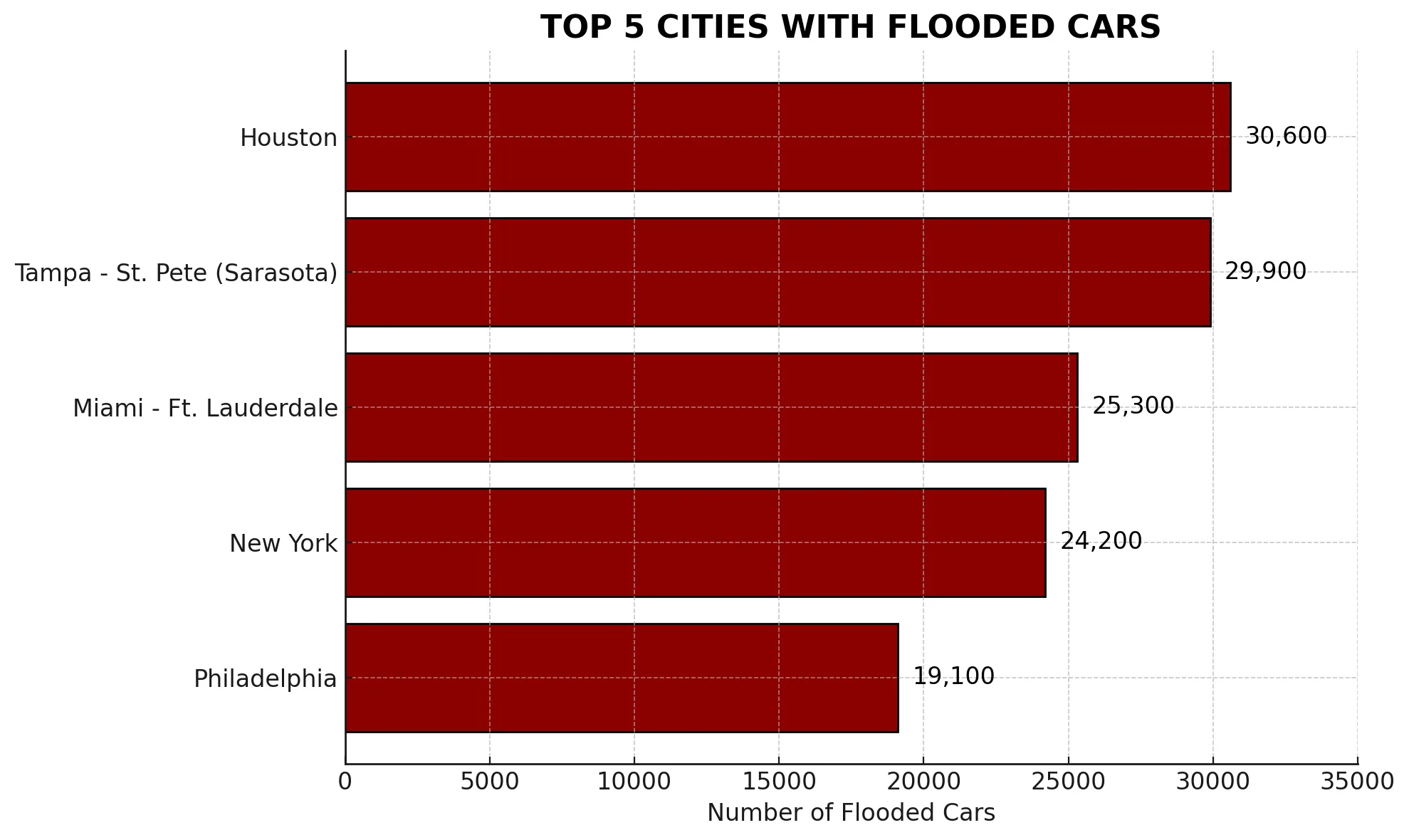

When a hurricane strikes Florida, the toll on vehicles is often catastrophic. After Hurricane Ian in 2022, state officials reported tens of thousands of flood-damaged vehicles across Southwest Florida. CARFAX later estimated that Ian alone damaged more than 358,000 vehicles across several states, many of them declared total losses because repairs were impossible. The 2024 hurricane season is shaping up similarly: Hurricane Helene damaged an estimated 138,000 vehicles across the Southeast, and just weeks later, Hurricane Milton added another 120,000 in Florida. Altogether, CARFAX estimates nearly 347,000 vehicles have already been affected by flood damage this season.

Flood and water damage remain the most severe threat. Saltwater storm surge corrodes metal, eats away at exhaust systems, and can lead to engine seizure, overheating, or total transmission failure. Electrical systems are equally vulnerable—floodwater can short-circuit wires, destroy onboard computers, and knock out dashboards or lighting altogether. Beyond the engine, water compromises safety features, warping brake rotors, disabling ABS systems, and even causing airbags or restraint systems to malfunction.

Hurricane damage doesn’t stop there. Health risks come into play when water fills the cabin. Muddy seats, fabric soaked with bacteria, and contaminated ventilation systems can make a car unsafe to drive even if it appears functional.

Wind and falling debris add another layer of destruction. Trees, roof tiles, and even road signs become projectiles in winds topping 100 mph, shattering glass, denting roofs, or caving in entire sections of a vehicle. Then comes the hidden damage: once windows are broken, water seeps inside, rust spreads fast, and wiring corrosion often goes unnoticed until weeks later. Insurers may try to minimize these issues, but anyone who has seen a flood-damaged car knows they are unsafe and often worthless on resale.

The reality is that hurricane damage comes in many forms from mechanical, electrical, safety, and even health hazards inside the cabin. And not all of it is obvious on day one. When the storm clears, the next battle for most drivers is proving the full extent of those losses to the insurance company.

Filing a Claim After Hurricane Car Damage

The Florida law has specific timing limits and the steps you should take when filing a hurricane damage claim.

How long after a hurricane can you claim damage?

Florida Statute § 627.70132 gives you up to one year to file a hurricane-related claim, but waiting can delay payment and complicate your case.

Claim Process

After a storm, filing your claim the right way can make the difference between a fair payout and months of frustration. Here’s what you should do if your car has been damaged after a hurricane:

- Document everything. Take photos and videos of your car before the storm if you can, and again right after. Capture water lines, broken windows, dents, and any interior damage. Keep receipts for emergency repairs or towing. This evidence helps prove the damage came from the hurricane, not normal wear and tear.

- Act quickly. Insurance companies receive thousands of claims after every major storm. The sooner you file, the sooner you move up in the queue.

- Be cautious with adjusters. Insurance adjusters often minimize damage or push you to sign a quick settlement. Don’t rush. If you accept a lowball offer, you may be stuck paying out of pocket for hidden damage later, like corroded wiring or mold that shows up weeks after the storm.

- Stay connected, even from a distance. If you evacuated or can’t be present, communicate by email or phone. You can also authorize a trusted person to meet the adjuster on your behalf.

Even with good documentation, insurers don’t always play fair. That’s why knowing when to bring in an attorney can protect your claim and your finances.

When You Might Need an Attorney For a Car Damage Claim After a Hurricane

Not every hurricane claim goes smoothly, and knowing when to bring in legal help can save you from costly mistakes. There are the most common situations where a lawyer makes a difference:

Case #1: Denied Claims

Insurers sometimes argue the damage wasn’t storm-related or blame “pre-existing conditions.” Without legal pressure, many drivers walk away with nothing after losing their cars in a hurricane.

Case #2: Lowball Offers

After major storms, used car prices in Florida often surge. Insurers may still calculate payouts using outdated values, leaving you thousands short of what it really costs to replace your vehicle.

Case #3: Delayed Payouts

Some families wait months while insurers stall, dragging out the claims process. Without transportation, everyday life becomes a struggle.

Case #4: Bad Faith Tactics

Carriers may push quick, cheap settlements while you’re still dealing with storm damage. Signing too soon can lock you into a payout far below what your policy actually allows.

This is where having a lawyer changes the outcome. We step in to challenge denials, negotiate for the real value of your loss, and hold insurers accountable under Florida law. You shouldn’t have to fight alone while trying to recover from a hurricane. Calling an attorney at the right time can protect your finances, reduce stress, and get you back on the road faster.

Of course, the best fight is the one you never have to start. Being prepared before hurricane season can reduce risks and make your claim stronger if disaster strikes.

Pre-Hurricane Tips to Protect Your Vehicle

Insurance can help after the fact, but the best move is reducing the risk before the storm arrives:

- Park smart: Use a garage or higher ground; cars left in flood zones are often total losses.

- Avoid hazards: Don’t leave your car under large trees or power lines.

- Remove valuables: Take out important documents and personal items to prevent theft or loss.

- Take photos: Document your car inside and out before the storm for proof during your claim.

These quick steps don’t stop a hurricane, but they strengthen your claim and protect your car as much as possible. Another important point Florida drivers often overlook is the restriction on policy changes right before a storm.

Timing and Policy Changes Before a Storm

Another less-known fact and one of the toughest lessons Florida drivers learn is that you can’t wait until a hurricane is already on the radar to adjust your coverage. Once a storm is named or a watch is issued, most insurers place binding restrictions on new policies and upgrades. That means no adding comprehensive coverage a day or two before landfall. The Office of Insurance Regulation in Florida allows companies to impose these moratoriums to prevent last-minute policy changes, and almost every major carrier enforces them.

For drivers, this creates a real pain point. Maybe you just bought a car or moved into a flood-prone area, and suddenly you’re stuck with liability coverage only. The takeaway is clear: review your coverage before hurricane season begins. If your policy doesn’t include comprehensive, don’t wait for the first tropical storm warning to find out the hard way.

Protecting Your Rights After the Storm

A hurricane can leave you feeling powerless, but when it comes to your vehicle, you still have options. The right coverage can repair or replace your car, and the right legal help can stop an insurance company from walking away with your money.

If your car was damaged in a Florida hurricane, don’t wait and don’t try to battle the insurance company alone. At Steinger, Greene & Feiner, our insurance claim attorney team has been helping Florida drivers through hurricane claims for decades, and we know how insurers operate after a storm. With offices across the state, including West Palm Beach, Miami, Fort Lauderdale, Tampa, Fort Myers, Orlando, Port St. Lucie, and more, and a team that understands the unique challenges of Florida’s coastal communities, we’re here to protect your rights and fight for the compensation you deserve. Call us for a free consultation, available 24/7. The sooner you reach out, the sooner we can start working to get you back on the road and back on your feet.